Yes, you can sell a house with a lien in North Carolina, but it’s important to resolve the lien before finalizing the sale to ensure a smooth transaction. This might include paying off the lien, negotiating with the lienholder, or placing sale proceeds in escrow. Transparency with buyers and consulting legal experts can help you navigate the process successfully. Keep reading to learn more!

Table of contents

- Can a house be sold with a lien on it North Carolina

- Selling a house with a lien on it North Carolina

- What is a property lien North Carolina?

- How do property liens work North Carolina?

- Types of property liens North Carolina

- Can you sell a house with a lien North Carolina?

- How to sell a house with a lien on it North Carolina

- How do liens impact a home sale North Carolina?

- Conclusion: Can you sell a house with a lien on it in North Carolina?

Can a house be sold with a lien on it North Carolina?

Yes, you can sell a property with a lien attached, provided the buyer agrees to pay off the lien at closing or the sale proceeds cover the lien balance before you receive your funds. While some buyers might be cautious about purchasing a property with a lien, many cash buyers are ready to move forward without hesitation.

Selling a house with a lien on it North Carolina

Selling a house on the real estate market can be challenging enough, but the process becomes even more complex when the property is encumbered by a lien. Many deals have been delayed or even canceled due to this issue. Therefore, it’s essential to resolve all existing liens before proceeding with a home sale.

Before selling a house with a lien, it’s essential to verify the validity of the lien. Once confirmed, the lien must be resolved—whether through payoff, transfer, or negotiation with the creditor. After settling the lien, be sure to obtain a lien release before listing the property. If funds are limited, the lien can often be paid off at closing using the sale proceeds. This article will explore each of these steps in detail.

We understand the stress that comes with selling a house with a lien. To aid in the process, we’ve compiled a comprehensive guide on selling a house with a lien in North Carolina.

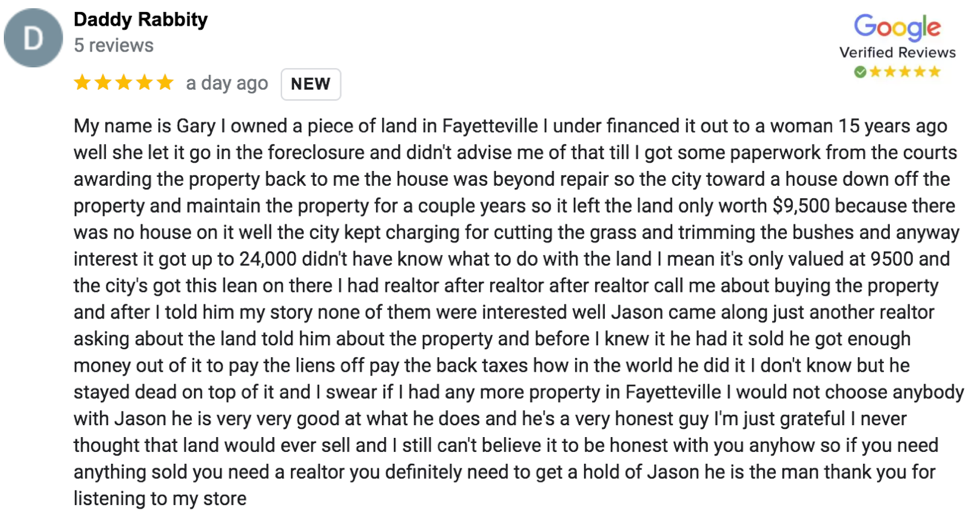

Case Study From the Author

Can a House be Sold with a Lien on it?

I have a deep understanding of buying and selling houses with liens in North Carolina. Since 2017 I have closed over 125 transactions on property involving a lien. I speak to many homeowners who are under the impression that they cannot sell their house because of an existing lien or judgment against the property. Here is a case study with Gary, who had let the city condemn his house due to insurmountable debts against the home.

When I met Gary, he was crippled with credit damage from years of unpaid debts owed to the state and city. Over time the house became uninhabitable and the city condemned the home. They had placed liens on the property for code violations as well as ongoing tax liens. Gary had given up on the home years ago and told me he “let the city have it back” because he concluded the liens were worth more than the value of the land.

We contacted the city and got a payoff on all the liens. It came to seven years of backed taxes and over nine liens from the city that needed to be paid in order for him to sell the property and clear his name from the debt – a task he thought impossible. We ended up making him an offer that paid off all his debt in full and now there’s a beautiful home sitting on the property. If you’re in a similar situation, don’t give up hope! Find a reputable home buyer who is willing to put in the extra work to see what needs done to clear the liens. We’ve helped many in this situation – hopefully this helps you too!

-Jason Hill, Freedom Choice Investments

What is a property lien North Carolina?

A property lien is a legal claim placed on a property by a creditor as security for a debt owed by the property owner. It gives the creditor the right to take possession of the property and sell it to satisfy the debt if the debtor fails to fulfill their financial obligations. Liens can be placed by various entities, including mortgage lenders, tax authorities, contractors, or judgment creditors.

How do property liens work North Carolina?

When a property owner neglects to settle an outstanding debt, the creditor may pursue repayment by filing a lien. This filing involves recording the lien in the local county recorder’s office, effectively making it a matter of public record.

In this context, the individual who initiates the lien is referred to as the lien holder, gaining a legal entitlement to a portion of the property once the lien is sanctioned. While most liens are approved by the North Carolina court, there are instances where the homeowner may voluntarily grant the lien.

For instance, if you’ve defaulted on your mortgage payments, the lender might file a lien against your property. Once approved by the court, the lender gains a claim to a portion of your North Carolina property. Failure to settle the debt could result in the lender seizing the property and selling it to recover some of their losses.

In such circumstances, the borrower or property owner won’t hold a clear title if a lien is imposed on their property. Essentially, the owner forfeits the ability to independently sell the property, requiring consent from the lien holder to proceed with a sale. Moreover, a lien can impede the subdivision of the house and hinder the owner from securing a mortgage until the lien is resolved.

Types of property liens North Carolina

Now that you have a fundamental understanding of liens and their functioning, let’s delve into the various types of liens prevalent in North Carolina. Below, we outline some of the most commonly utilized liens by creditors today.

Mortgage Lien

Mortgage liens are the most common type of lien placed on a property. Homeowners typically agree to these liens during the loan closing process. Essentially, a mortgage lien serves as a legal claim against the property, acting as collateral for the mortgage loan. If the homeowner defaults on payments, the lender has the right to sell the property to recover their losses.

Property Tax Lien

A property tax lien is filed against a property when the owner fails to pay their real estate taxes. If the lien remains unpaid, the government has the authority to sell the property to recover the owed taxes, along with any penalties and interest. When multiple liens exist, property tax liens usually take priority over all others.

IRS Lien

When property owners fail to pay their income taxes, the federal government may file an Internal Revenue Service lien, also known as an IRS lien, against their property. If the IRS liens remain unpaid, the government has the authority to foreclose on the property to settle the homeowner’s outstanding taxes.

Homeowner’s Association (HOA) Lien

The homeowner’s association lien, or HOA lien, is imposed on a property when the owner neglects to pay the fees and assessments required by the HOA. Although not as severe as tax liens, HOA liens can have significant consequences. Typically, HOAs collect fees or dues to finance security, landscaping, and maintenance, as well as to fund special assessments for community-owned property improvements. If a homeowner fails to settle these obligations, the HOA reserves the right to initiate foreclosure proceedings on the property, regardless of whether the owner’s mortgage payments are current.

Judgment Lien

A judgment lien, alternatively known as a judicial lien, is registered against a property when its owner loses a lawsuit and is unable to satisfy the judgment. Essentially, if an individual is sued, loses the court case, and cannot fulfill the judgment, the prevailing party can file a judgment lien against their assets, including real estate.

Mechanic’s Lien

A mechanic’s lien—also known as a construction lien, designer lien, or materialman lien—is placed on a property when a homeowner fails to pay contractors for their work. This type of lien also covers unpaid debts to designers, engineers, and architects involved in the project.

Child Support and Alimony Lien

A child support or alimony lien is placed on a property when the owner fails to meet court-ordered child support or alimony payments. While the court may allow the property to be sold despite the lien, obtaining court approval for the sale is often a lengthy and complex process.

Can you sell a house with a lien North Carolina?

Yes, you can sell a property with a lien in North Carolina. However, unless it’s a mortgage lien, it’s best to resolve the lien before closing to prevent delays. We understand this can be difficult, especially if you’re facing financial challenges, but in North Carolina, the closing attorney will require all outstanding debts and liens to be satisfied before the sale can close, ensuring the buyer receives a clear title.

If the sales price covers or exceeds the outstanding lien debt, it may be possible to pay these creditors from your proceeds at closing. We recommend consulting with a real estate attorney and communicating with the lienholder beforehand to understand your options.

In rare cases, a buyer may agree to purchase a house with an existing lien, though most buyers tend to be cautious about buying a property with liens attached. If a buyer is willing to close before the lien is paid off, you will need to use the sale proceeds to clear the lien immediately after closing. Including a clause in the closing agreement that ensures this can help convince the buyer to proceed with the sale despite the active lien.

How to sell a house with a lien on it North Carolina

To sell a North Carolina house with one or more liens, you can adhere to the procedure outlined in this section. It is advised that the steps detailed below should be addressed before advancing with the sale.

Discover existing liens

To determine if your property has a lien, you can conduct a title search. This involves examining public records to confirm the legal ownership and titles of the property. These documents, including land records, deeds, court judgments, and more, are typically accessible at the county records office.

Performing a property lien search independently can be time-consuming. Therefore, we suggest utilizing the services of a North Carolina title company, which can expedite the process for a nominal fee.

Determine the legitimacy of the lien

Occasionally, a lien placed on your property may be illegitimate or inaccurate. Therefore, it’s prudent to thoroughly assess the lien to ascertain its validity.

Seeking assistance from a North Carolina real estate attorney or advisor is advisable in such circumstances. If they discover a fraudulent lien, they can assist you in contesting the outstanding debts, relieving you of the financial burden. Additionally, any inaccuracies with the lien, such as outdated or incorrect information, can be rectified with their help.

Take care of the lien

Once you’ve verified the validity of the liens, it’s crucial to address them promptly. There are three approaches to accomplishing this: paying off the lien, transferring it to a different property, or engaging in negotiations with the creditor.

Pay off the lien

The most effective method to resolve a lien is by paying it off immediately. This is typically straightforward if the outstanding debt is minimal. However, if the debt exceeds what you can afford upfront, settling it at closing may be necessary.

Transfer the lien

In certain scenarios, it’s possible to transfer a property lien to another house or property that you own. If the transfer is approved, the property being sold will possess a clear title, and the payment of the lien can be postponed. The process of transferring liens typically requires the assistance of a real estate attorney.

Negotiate the lien with creditor

It’s possible to negotiate directly with the lender holding the lien on your property. Depending on the agreement, the outstanding balance might be reduced, or alternative payment plans—including hybrid solutions—could be arranged. To help navigate these negotiations effectively, it’s recommended to work with a real estate attorney.

Obtain lien satisfaction in writing

After all liens on the property have been settled, it’s crucial to obtain official documentation confirming the lien’s discharge. This is usually provided as a payoff letter or a lien release form from the creditor, verifying that all outstanding debts have been paid and the property has a clear title. Once received, this documentation should be filed with the county clerk’s office to formally record the termination of the lien.

Proceed with a sale

After the lien has been settled and recorded with the county you are free to begin marketing the house for sale. You have two primary options for selling your house. You can either use real estate agent to market your house for sale or you can choose to skip the hassle of showings and home repairs by selling directly to a qualified cash home buyer who can buy the house as-is and close in as little as 7-14 days.

Alternative option: Use sales proceeds to settle the lien

If you’re facing a substantial outstanding debt, one option is to use the proceeds from selling the house if it holds sufficient equity. As previously mentioned, you can discuss with your real estate agent and the buyer about the inclusion of a clause in the closing statement, specifying that a portion of the sales proceeds will be allocated to pay off the lien.

While this approach is feasible, some buyers may perceive it as risky, particularly if the debt surpasses the property’s value. If a buyer is not comfortable with the clause, they retain the option to withdraw from the sale.

How do liens impact a home sale North Carolina?

A lien on your North Carolina home can impact its sale in various ways, as outlined below.

Selling to retail buyers can be a challenge

Having a lien on your home can pose challenges in attracting conventional retail buyers (like a prospective homeowner), leading to difficulty and prolonged efforts in selling your North Carolina property.

This challenge is exacerbated when there are multiple involuntary liens on the house. Moreover, if the outstanding debt is substantial or involves unpaid federal taxes, it may deter potential retail buyers who perceive the property as a risky investment.

Liens can attract cash buyers

It may come as a surprise, but having a lien on your house can draw the interest of specific buyers, including real estate investors, flippers, and cash buyers.

These motivated buyers often prefer negotiating directly with the owner to settle the lien and purchase the house rather than participating in auctions. This allows an investor to view the property in person before purchasing – contrary to what is found at auctions.

You may get less money

It may seem obvious, but selling a house in North Carolina with liens will likely result in lower proceeds compared to a sale without liens. This is because a significant portion of the sale price must be used to pay off the outstanding debts, which reduces your potential profit. Additionally, buyers may be reluctant to pay top dollar for a property burdened by liens.

You can incur costs for professional services

Navigating the sale of a house with a lien can be intricate during the closing process, particularly when dealing with liens related to property taxes or IRS matters. Seeking advice from a seasoned attorney is advisable to ensure proper legal steps are taken.

It’s important to note that legal assistance for resolving tax liens and other involuntary liens comes at a cost. Real estate attorneys typically charge between $150 to $350 per hour for their services, which must be settled once all matters are resolved.

The buyer could attempt to re-negotiate

Discovering that a property is encumbered by a lien, particularly those associated with business or federal taxes, may lead potential buyers to presume financial strain and seek to renegotiate for a lower sales price.

In some cases, buyers may only propose an offer equivalent to the amount owed for the lien. It’s crucial to meticulously review your purchase agreement before finalizing the contract with a buyer.

Conclusion: Can you sell a house with a lien on it in North Carolina?

Selling your North Carolina house with liens may pose challenges, but it’s certainly feasible. By adhering to the outlined procedure, you can navigate the process smoothly without encountering significant hurdles. Additionally, it’s highly recommended to enlist the assistance of a North Carolina real estate attorney who can adeptly manage the legal aspects on your behalf.

These findings apply to all cities and towns in North Carolina, including Raleigh, Durham, Fayetteville, Johnston County, Sanford, Burlington, and surrounding areas.

Related Articles

Can you sell a house in foreclosure in North Carolina?

How to sell rental property in North Carolina (and avoid paying taxes)?

Selling a house as-is in North Carolina (How to sell a house that needs repairs)

How much are seller closing costs in North Carolina?

Can a house be sold with a lien on it in North Carolina?

A guide to selling a house with tenants in North Carolina

A guide to selling inherited property in North Carolina

Selling a house during divorce in North Carolina

Selling house for job relocation North Carolina

Selling a fire damaged house North Carolina

Selling a house with code violations North Carolina

At Freedom Choice Investments we buy properties in North Carolina in any condition and in any circumstance – even those with liens attached. We pay cash for properties making the transaction quick and easy. We even have real estate attorney’s who work with us that can help expedite the lien settlement process for you.

If you’re interested in selling a property with a lien in North Carolina, fill out the form below or contact us at (919) 285-1284 for a no-obligation cash offer.

Sell My House Fast For Cash Today!

Get started now. Fill out the form to receive your cash offer in minutes. There’s no obligation. We buy houses in any condition and always close on YOUR timeline.

Author: Jason Hill

I am a seasoned real estate agent and investor with nearly a decade of experience helping my clients navigate the intricacies of selling a house with a lien in North Carolina. As the founder of Freedom Choice Investments my mission is to deliver simple and hassle free selling solutions to North Carolina homeowners. With the ability to either list your house or buy it as-is we have a unique offering that caters to those looking for ways to sell a house with a lien attached in North Carolina.